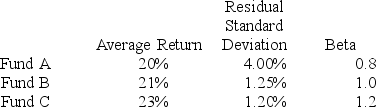

You want to evaluate three mutual funds using the information ratio measure for performance evaluation. The risk-free return during the sample period is 6%, and the average return on the market portfolio is 19%. The average returns, residual standard deviations, and betas for the three funds are given below.

The fund with the highest information ratio measure is

Definitions:

Analogue Observational Setting

An artificial environment set up in an office or laboratory to elicit specific classes of behaviour in individuals. Used when in vivo observation in the natural environment is impractical because of time constraints and the unpredictability of modern family life.

Subject Reactivity

A phenomenon in which individuals alter their behavior or responses due to their awareness of being observed or studied.

Actuarial Prediction

A method used in various fields, including psychology and criminal justice, that utilizes statistical models to forecast future outcomes based on historical data.

Q2: Social Security is _.<br>A) a pension plan

Q5: At the early stage of an individual's

Q8: What effect can giving individual feedback have

Q21: The option smirk in the Black-Scholes option

Q39: The market capitalization rate on the stock

Q41: You are a U.S. investor who purchased

Q66: Caribou Gold Mining Corporation is expected to

Q76: Economists often focus on average behavior because

Q80: _ is the amount of money per

Q90: You invest in the stock of Rayleigh