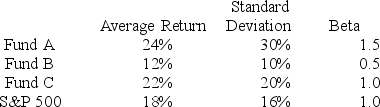

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The fund with the highest Sharpe measure is

Definitions:

Accomplishments

Achievements, successes, or completed goals, often resulting from effort or skill.

Spotlight Effect

The cognitive bias where an individual overestimates how much others notice their appearance or behavior.

Self-efficacy

An individual's belief in their capacity to perform tasks needed to realize specific results.

Collectivist Self

An aspect of self-identity that is defined and valued by in-group relationships, prioritizing the group over the individual.

Q1: What are the three types of social

Q7: What type of performance pay is more

Q12: Which is a constraint on international IR

Q13: You want to earn a return of

Q14: What is it called when practices and

Q28: The following data are available relating to

Q35: Which of the following typically employ(s) significant

Q39: Which of the following provides the profit

Q84: An investor would want to _ to

Q84: A firm's leverage ratio is 1.2, interest-burden