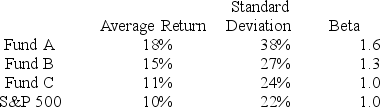

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 4%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The fund with the highest Sharpe measure is

Definitions:

Snippet

A small portion or extract from a larger text or data set, typically used for quoting or programming code examples.

Block The Sender

A feature in email and messaging services used to prevent further messages from a specific source.

Default Reminder Time

The preset time period before an event when a reminder notification is automatically sent or displayed.

Incoming Mail Server

A server that receives and stores email messages sent to a user, allowing them to download or view the messages later using an email client.

Q4: Which of the following is a change

Q11: What is NOT a current economic trend?<br>A)

Q14: Lifecycle Motorcycle Company is expected to pay

Q15: Which of these is a common MNE

Q16: A hypothetical futures contract on a nondividend-paying

Q20: If a firm's ratio of stockholders' equity/total

Q20: Consider a hedge fund with $250 million

Q23: In what industry are investors likely to

Q55: An investor wants to retire when she

Q59: Suppose two portfolios have the same average