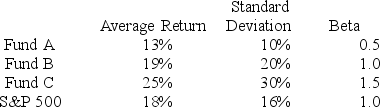

You want to evaluate three mutual funds using the Treynor measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, in addition to information regarding the S&P 500 Index.

The fund with the highest Treynor measure is

Definitions:

RAP Framework

A structured approach to problem-solving or project management, focusing on Research, Analysis, and Presentation.

Potential Leaders

Individuals within an organization who have the skills, attributes, and the potential to assume leadership roles in the future.

Global Mind-Set

An approach that considers the full spectrum of cultural, economic, and geopolitical factors when making business decisions on a global scale.

Market Savvy

A leader’s ability to be accountable for the products and services they deliver in a local market.

Q2: What is a reason why firms engage

Q13: What is an example of a boundary

Q29: A 1-year oil futures contract is selling

Q34: Assume there is a fixed exchange rate

Q40: Cash Flow Data for Interceptors, Inc.<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6474/.jpg"

Q50: A high water mark is a limiting

Q52: You believe that the spread between the

Q81: Rose Hill Trading Company is expected to

Q85: The financial statements of Flathead Lake Manufacturing

Q86: The amount of risk an individual should