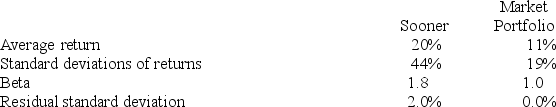

The following data are available relating to the performance of Sooner Stock Fund and the market portfolio:

The risk-free return during the sample period was 3%.

What is the Treynor measure of performance evaluation for Sooner Stock Fund?

Definitions:

Hedge

An investment made to reduce the risk of adverse price movements in an asset.

Speculative Forward Contract

A financial derivative used to speculate on the future price of an asset, involving an agreement to buy or sell the asset at a future date for a price determined today.

Fair Value Hedge

A risk management technique that uses financial instruments to mitigate the risk associated with changes in the fair value of an asset or liability.

Firm Commitment

An agreement between a buyer and an underwriter in which the underwriter guarantees the sale of a certain amount of securities.

Q10: The firm's leverage ratio is 1.2, interest-burden

Q13: You purchase one MBI March 120 put

Q19: Management fees for hedge funds typically range

Q30: Medfield College's $10 million endowment fund is

Q33: _ are mutual funds that invest in

Q34: A market neutral hedge fund is likely

Q37: A time spread may be executed by

Q51: The clearing corporation has a net position

Q62: Most professionally managed equity funds generally<br>A) outperform

Q64: Someone who commits the fallacy of composition