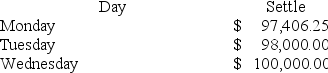

On Monday morning you sell one June T-bond futures contract at $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700, and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer the following questions.

The cumulative rate of return on your investment after Wednesday is a ________.

Definitions:

Straight-Line Depreciation

A depreciation technique that allocates an equal amount of depreciation each year over the asset's useful life.

Residual Value

The estimated amount that an asset is expected to sell for at the end of its useful life, subtracting any disposal costs.

Impairment Loss

A recognized reduction in the recoverable amount of an asset, indicating that its market value has dropped below its book value on the balance sheet.

Double-Declining-Balance

A method of accelerated depreciation which doubles the regular depreciation amount.

Q6: Which one of the following exploits differences

Q12: The Sharpe, Treynor, and Jensen portfolio performance

Q13: A higher-dividend payout policy will have a

Q18: Which of the following is the least

Q35: The financial statements of Burnaby Mountain Trading

Q42: A stock is trading at $50. You

Q48: To attract new clients, hedge funds often

Q77: The yield curve spread between the 10-year

Q86: Use the following cash flow data of

Q87: Cost of goods sold refers to _.<br>A)