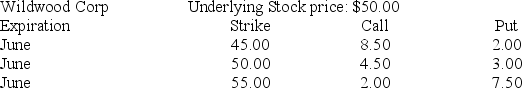

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

To establish a bull money spread with calls, you would ________.

Definitions:

Virtual Goods

Non-tangible items that exist in digital form, often used within online communities, games, or virtual economies.

Personal Property

All types of property except land and the buildings on it, including movable items and intangible assets.

Real Property

Land and anything permanently affixed to it, such as buildings and trees, considered a form of real estate.

Personal Property

Items of property that are not fixed to one location and can be moved, such as furniture, vehicles, and electronics.

Q23: You hold a subordinated debenture in a

Q23: Hedge ratios for long call positions are

Q31: You are cautiously bullish on the common

Q34: Research suggests that option-pricing models that allow

Q52: If the risk-free interest rate is rf

Q60: The fastest-growing category of hedge funds is

Q61: Which of the following would result in

Q65: The price on a Treasury bond is

Q66: According to the Black-Scholes option-pricing model, two

Q76: Sanders, Inc., paid a $4 dividend per