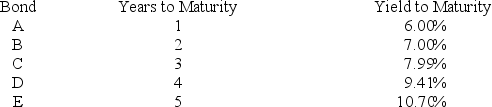

Consider the following $1,000 par value zero-coupon bonds:

The expected 1-year interest rate 4 years from now should be ________.

Definitions:

Napalm

A highly flammable sticky jelly used in incendiary bombs and flamethrowers, notorious for its use in military conflicts to cause severe burns.

Strategic Hamlets

A program implemented during the Vietnam War, aiming to combat communist insurgency by relocating rural populations to fortified villages.

Shuttle Diplomacy

A negotiation method where an intermediary travels between two or more parties located in different places to prevent direct conflict and encourage dialogue.

Stagflation

An economic condition characterized by slow growth, high unemployment, and rising inflation, often occurring simultaneously.

Q5: Short interest is a _ indicator.<br>A) sentiment<br>B)

Q6: You invest in the stock of Valleyview

Q7: Value stocks are more likely to have

Q10: Lear Corp. has an expected excess return

Q25: Jaffe found that stock prices _ after

Q48: _ is an important characteristic of the

Q63: A firm increases its dividend plowback ratio.

Q66: A support level is _.<br>A) a level

Q68: In his famous critique of the CAPM,

Q90: Stock prices that are stable over time