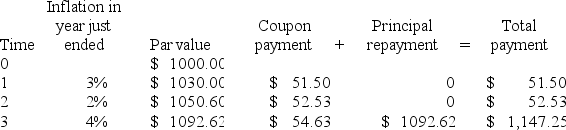

Consider a newly issued TIPS bond with a 3-year maturity, par value of $1,000, and coupon rate of 5%. Assume annual coupon payments.

What is the real rate of return on the TIPS bond in the first year?

Definitions:

Operating Income

Earnings before interest and taxes (EBIT), representing the profit a company makes from its operations.

Unit Selling Price

The price at which an individual unit of a product is sold to customers.

Unit Variable Costs

These are the costs that change directly with the level of production or service activity, such as materials and labor.

Break-even Sales

The amount of revenue required to cover total fixed and variable costs, resulting in neither profit nor loss.

Q3: The reward-to-volatility ratio is given by _.<br>A)

Q23: When all investors analyze securities in the

Q24: Historically, the best asset for the long-term

Q35: Assuming all other factors remain unchanged, _

Q35: If investors overweight recent performance in forecasting

Q43: You invest $10,000 in a complete portfolio.

Q59: Suppose that a stock portfolio and a

Q69: The value of Internet companies is based

Q76: Sanders, Inc., paid a $4 dividend per

Q77: You can be sure that a bond