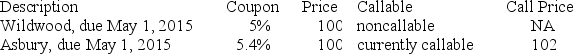

On May 1, 2007, Joe Hill is considering one of the following newly issued 10-year AAA corporate bonds.

Suppose market interest rates decline by 100 basis points (i.e., 1%) . The effect of this decline would be ________.

Definitions:

Unit Variable Cost

The cost associated with producing one additional unit of a product, including labor, material, and other variable costs.

Profit Maximized

The condition in which a firm achieves the highest possible level of profit through the optimization of production and pricing strategies.

Sales Level

The actual quantity or volume of products or services sold within a specific time frame.

Break-even Analysis

A financial calculation to determine the point at which revenue received equals the costs associated with receiving the revenue.

Q7: Investing in two assets with a correlation

Q16: Given its time to maturity, the duration

Q16: The yield to maturity on a bond

Q39: _ are partnerships of investors with portfolios

Q51: The portfolio with the lowest standard deviation

Q51: In a single-factor market model the beta

Q60: If the simple CAPM is valid and

Q62: A call option on Brocklehurst Corp. has

Q78: A firm is expected to produce earnings

Q87: In 2012, the S&P 500 increased 16%.