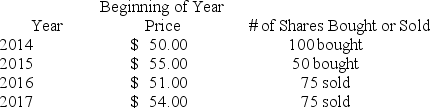

You have the following rates of return for a risky portfolio for several recent years. Assume that the stock pays no dividends.

What is the dollar-weighted return over the entire time period?

Definitions:

Adverse Selection

A situation in which one party in a transaction possesses information that the other party does not, leading to an imbalance in the transaction that can result in market inefficiency.

Asymmetric Information

A situation in which one party in a transaction has more or superior information compared to another. This can lead to an imbalance in power and potentially unfair transactions.

Genetic Tests

Procedures used to identify changes in chromosomes, genes, or proteins to predict disease risk, diagnose diseases, or identify carriers of disease.

Mechanism Design

An area of economics that explores how contract or transaction structures can overcome asymmetric information problems.

Q8: The market value weighted-average beta of firms

Q22: What is the expected return on a

Q28: Which type of fund is often priced

Q30: On a particular day, there were 890

Q59: "Buy a stock if its price moves

Q67: To make the world better fit the

Q69: When technical analysts say a stock has

Q83: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6474/.jpg" alt=" Identify the resistance-level

Q84: Which of the following is a false

Q156: When the "bad boys" get together, they