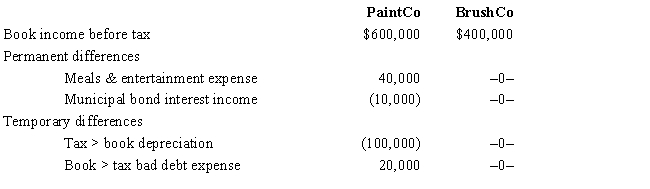

PaintCo Inc., a domestic corporation, owns 100% of BrushCo Ltd., an Irish corporation. Assume that the U.S. corporate tax rate is 35% and the Irish rate is 15%. PaintCo is permanently reinvesting BrushCo's earnings outside the United States under ASC 740-30 (APB 23). There is no valuation allowance, and the effective tax rates do not change. PaintCo's book income, permanent and temporary book-tax differences, and current tax expense are reported as follows.

Provide the GAAP income tax footnote rate reconciliation for PaintCo, using both dollar amounts and percentages.

Definitions:

Leisure

The time available for ease and relaxation where no work is done, often considered as time spent away from business, work, job hunting, domestic chores, and education.

Workers' Incomes

The financial compensation received by employees for their labor, including wages, salaries, and bonuses.

Labor Supplied

The total hours of work that workers are willing to offer at a given wage rate.

Hourly Wage Rate

The amount of money paid for each hour of work.

Q11: Texas is in the jurisdiction of the

Q23: Both economic and social considerations can be

Q28: How is qualified production activities income (QPAI)

Q36: Vic's at-risk amount in a passive activity

Q61: Create, Inc., a domestic corporation, owns 100%

Q75: The "luxury auto" cost recovery limits change

Q83: Residential rental real estate includes property where

Q106: Under the original issue discount (OID) rules

Q170: In applying the $1 million limit on

Q185: Briefly discuss the two tests that an