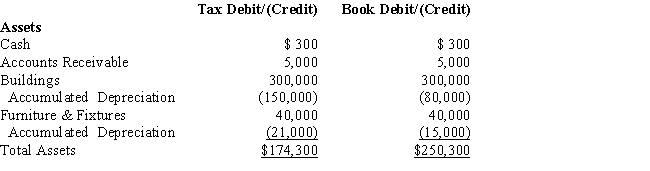

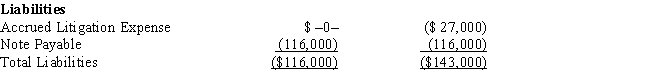

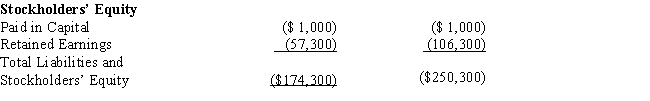

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the

end of the year. Assume a 35% corporate tax rate and no valuation allowance.

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals

and entertainment expense. Determine the net deferred tax asset or net deferred tax liability at year end.

Definitions:

Defense Mechanisms

Psychological strategies employed by individuals to cope with reality and maintain self-image by unconsciously denying or distorting reality.

Repression

A defense mechanism in psychoanalytic theory where distressing thoughts and feelings are unconsciously blocked from conscious awareness.

Self-Esteem

A person's personal assessment of their value, including both their thoughts and feelings about themselves.

Standardized Personality Tests

Psychological instruments used for measuring and evaluating an individual's personality traits and characteristics in a consistent manner.

Q7: In terms of revenue neutrality, comment on

Q24: Juan, was considering purchasing an interest in

Q29: A bribe to the local sheriff, although

Q34: Placard, a multinational corporation based in the

Q43: Cash flows from operations are the net

Q48: Graham, a CPA, has submitted a proposal

Q59: International accounting standards are said to be

Q60: Maddux Ltd has completed its financial year

Q67: Norm's car, which he uses 100% for

Q204: A used $35,000 automobile that is used