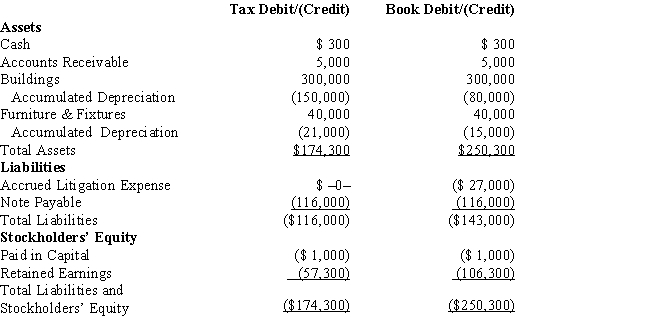

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 35% corporate tax rate and no valuation allowance.

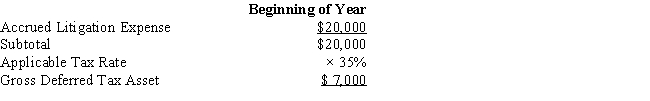

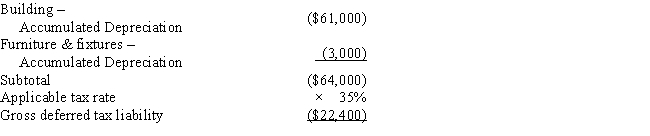

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals

and entertainment expense. What is Black's total provision for income tax expense reported on its

GAAP financial statement and its book net income after tax?

Definitions:

Labor Organization

A group, often in the form of a union, that represents the collective interests of workers in negotiations with employers regarding wages, working conditions, and rights.

Mechanization

The process of changing from working largely or exclusively by hand or with animals to doing that work with machinery.

Cotton Mills

Factories equipped for the processing and manufacturing of cotton into yarn or fabric, pivotal to the Industrial Revolution.

Labor Management

The process of managing the relationship between employers and their workforce, including aspects like hiring, training, and negotiating labor contracts.

Q8: Which of the following are the primary

Q8: Post-1984 letter rulings may be substantial authority

Q10: Incentives for ethical behaviour are:<br>A) market forces.<br>B)

Q29: The external auditors of the company report

Q44: Carin, a widow, elected to receive the

Q52: DuPont equation: Sorenstam Corp has an equity

Q57: Five years ago, Tom loaned his son

Q58: Identify the factors that should be considered

Q60: Yahr, Inc., is a domestic corporation with

Q86: South, Inc., earns book net income before