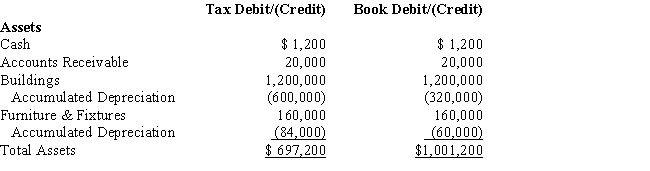

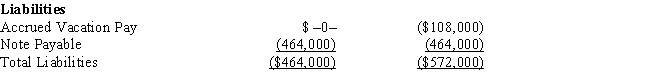

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 34% corporate tax rate and no valuation allowance.

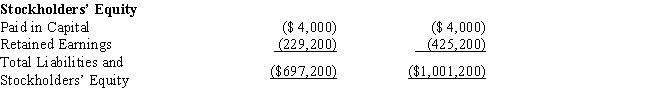

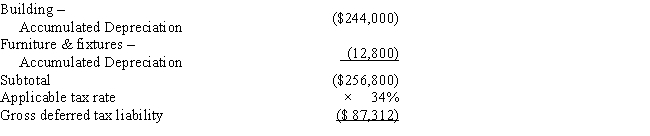

Amelia, Inc.'s, gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia, Inc.'s, book income before tax is $25,200. Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense. Determine the change in Amelia's deferred tax assets for the current year.

Definitions:

Year 0 Value

Year 0 Value is a reference point in financial analysis indicating the value of an investment or project at the beginning period before any growth or decline.

Weighted Average

Weighted average is a calculation that takes into account the varying degrees of importance of the numbers in a data set.

Free Cash Flows

The amount of cash generated by a business that is available for distribution to its securities holders after capital expenditures.

Year 0 Value

A reference to the initial value or investment amount at the beginning of a project or investment period, often used in financial analysis.

Q3: The Federal estate and gift taxes are

Q8: Mike contracted with Kram Company, Mike's controlled

Q21: The assumption of arm's-length transaction states that:<br>A)

Q40: Last year, Amos had AGI of $50,000.

Q40: Paige is the sole shareholder of Citron

Q47: "Other casualty" means casualties similar to those

Q60: If you have loaned capital to a

Q81: What are Treasury Department Regulations?

Q103: Harold bought land from Jewel for $150,000.

Q171: Percentage depletion enables the taxpayer to recover