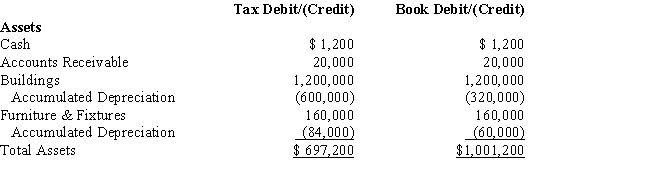

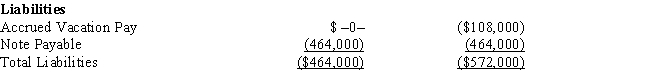

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 34% corporate tax rate and no valuation allowance.

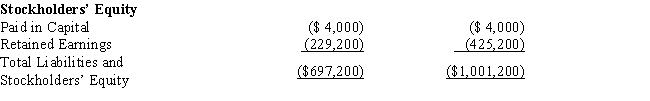

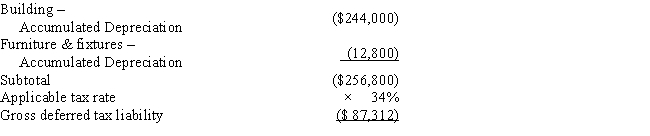

Amelia, Inc.'s, gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia, Inc.'s, book income before tax is $25,200. Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense. Determine Amelia's change in net deferred tax asset or net deferred tax

liability for the current year, and provide the journal entry to record this amount.

Definitions:

Familiarity Breeds

A phrase that highlights how extensive knowledge or close association with something or someone can lead to a loss of respect or interest, commonly referred to as "familiarity breeds contempt."

Liking

A positive emotional response or preference for someone or something.

Charles Darwin

A British naturalist renowned for his theory of evolution and the process of natural selection.

Leon Festinger

A psychologist known for his theory of cognitive dissonance, which suggests that people experience discomfort when they hold contradictory beliefs, leading them to change their attitudes or behaviors.

Q5: Under the MACRS straight-line election for personalty,

Q21: Under what circumstances may a taxpayer deduct

Q31: The "petitioner" refers to the party against

Q70: Typical financing activities include cash payments on

Q79: Salaries are considered an ordinary and necessary

Q105: A deduction for certain expenses (interest and

Q108: Jason's business warehouse is destroyed by fire.

Q120: A taxpayer may elect to use the

Q157: Cream, Inc.'s taxable income for the current

Q208: Research and experimental expenditures do not include