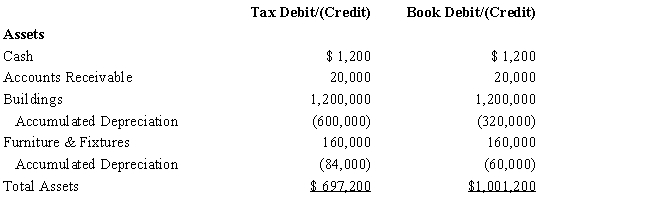

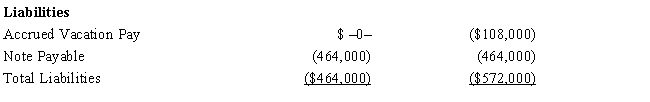

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 34% corporate tax rate and no valuation allowance.

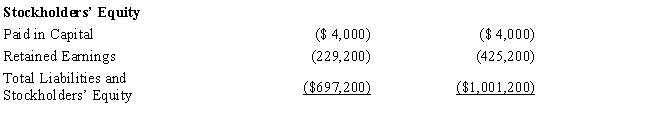

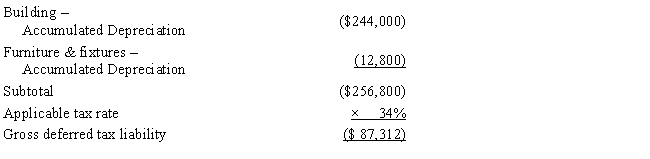

Amelia, Inc.'s, gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia, Inc.'s, book income before tax is $25,200. Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense. Calculate Amelia's current tax expense.

Definitions:

Dissolved

The process by which a company or partnership formally closes its business and ceases operations.

Limited Partner

A partner in a partnership whose liability is limited to the amount of their investment, and who typically does not participate in the day-to-day management of the business.

Limited Partnership

A form of partnership consisting of at least one general partner and one limited partner, where the latter has limited liability.

Capital Contribution

The act of injecting funds or other assets into a company or partnership by its owners or partners to support its operations or investment activities.

Q5: The process of converting financial securities with

Q7: The amount received for a utility easement

Q9: PaintCo Inc., a domestic corporation, owns 100%

Q42: Which of the following is an appropriate

Q44: Which corporate officer, when he or she

Q51: The financing decision determines how companies raise

Q54: Accounting standards prescribed by GAAP are important

Q55: Tom, a cash basis taxpayer, purchased a

Q58: Identify the factors that should be considered

Q184: Martin is a sole proprietor of a