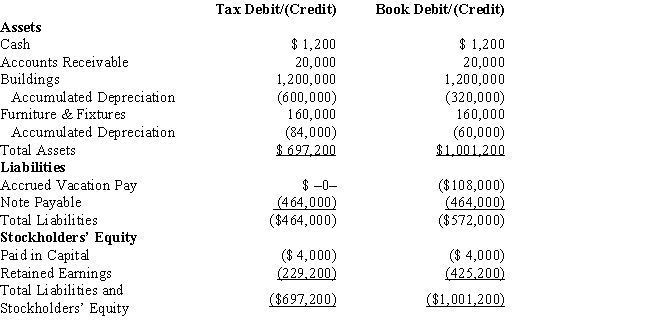

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 34% corporate tax rate and no valuation allowance.

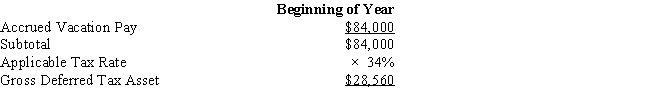

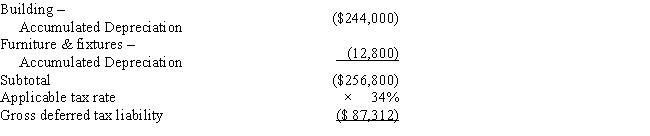

Amelia, Inc.'s, gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia, Inc.'s, book income before tax is $25,200. Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense. What is Amelia's total provision for income tax expense reported on its

financial statement and its book net income after tax?

Definitions:

Personal Finance Software

Computer programs that help individuals manage their financial accounts and investments, track spending, and budget.

Total Cost

The complete expenditure incurred in the production, operation, or provision of goods or services, including both fixed and variable costs.

Software Package

A bundle of software applications or programs typically designed to perform a specific group of tasks or functions and sold as a single product.

Cost Plus Pricing

A pricing strategy where the selling price is determined by adding a specific markup to a product's unit cost.

Q3: The Federal estate and gift taxes are

Q21: Roy is considering purchasing land for $10,000.

Q42: Purple, Inc., a domestic corporation, owns 80%

Q45: Double taxation of corporate income results because

Q54: What are some of the main limitations

Q66: On July 15, 2016, Mavis paid $275,000

Q69: Executives that repeatedly put their own interests

Q74: What is a Technical Advice Memorandum?

Q81: From January through November, Vern participated for

Q127: James is in the business of debt