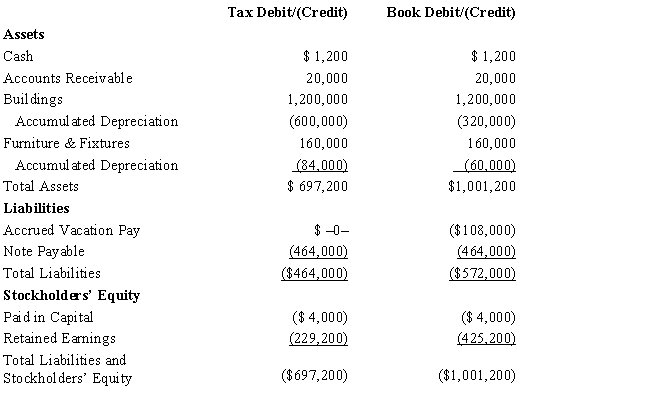

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 34% corporate tax rate and no valuation allowance.

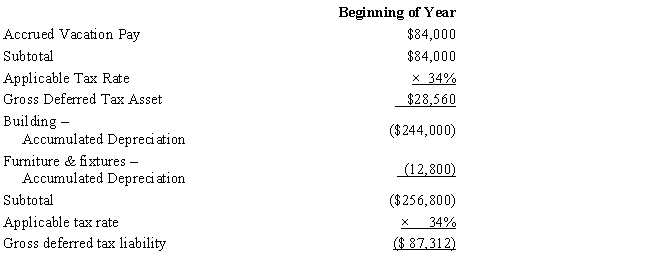

Amelia, Inc.'s, gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia, Inc.'s, book income before tax is $25,200. Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense. Provide the income tax footnote rate reconciliation for Amelia, using either dollars or percentages.

Definitions:

Client Interview

A professional meeting where a lawyer seeks to understand a client's legal needs, gather information about a case, and establish how they can assist.

Attorney

A professional authorized to practice law; conducts lawsuits or gives legal advice.

File Workup Memo

A document prepared in legal settings, summarizing a case's facts, relevant law, and strategic considerations for use by attorneys.

Paralegal

A trained individual who assists attorneys in the delivery of legal services, performing tasks such as research and document preparation but not authorized to practice law.

Q23: The maximum cost recovery method for all

Q34: In § 212(1), the number (1) stands

Q36: Parrino Company has announced that its profit

Q55: Tom, a cash basis taxpayer, purchased a

Q58: Identify the factors that should be considered

Q63: The role of the financial system is

Q67: What form of business organisation is described

Q92: In a related party transaction where realized

Q94: Due to the population change, the Goose

Q95: On December 1, 2016, Daniel, an accrual