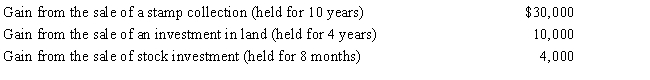

Perry is in the 33% tax bracket. During 2016, he had the following capital asset transactions:

Perry's tax consequences from these gains are as follows:

Definitions:

Maintains Control

A situation wherein an entity or individual continues to hold power or dominion over decision-making processes, assets, or other entities.

Remeasurement Event

A specific event that necessitates the recalibration of the value of a foreign currency transaction or the revaluation of a foreign operation.

Investment

Investment refers to the allocation of resources, usually money, with the expectation of generating an income or profit.

Control

The power to direct the management and policies of a company through ownership of its shares, rights, or contractual arrangements.

Q28: The purpose of the tax rules that

Q41: Services performed by an employee are treated

Q43: Where liquidation follows insolvency, the _ is/are

Q46: Doug and Pattie received the following interest

Q51: Tax bills are handled by which committee

Q51: On July 20, 2015, Matt (who files

Q71: After applying the balance sheet method to

Q78: PaintCo Inc., a domestic corporation, owns 100%

Q89: Tax brackets are increased for inflation.<br>A)Economic considerations<br>B)Social

Q120: Rita earns a salary of $150,000, and