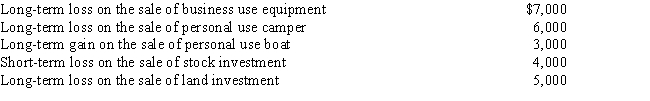

During the year, Irv had the following transactions:

How are these transactions handled for income tax purposes?

Definitions:

Income Taxes

Income taxes are taxes levied by governments on the profit of companies and income of individuals, subject to diverse regulations and rates.

LIFO Advantage

A financial benefit that comes from using the Last In, First Out method of inventory valuation, often resulting in lower taxes in periods of inflation.

Rising Prices

A situation in an economy where the general level of prices for goods and services is increasing, often referred to as inflation.

Holding Gains

Holding gains are the increased values of assets that a company holds, realized when the asset is sold or revalued.

Q20: Walter sells land with an adjusted basis

Q61: For real property, the ADS convention is

Q62: A jury trial is available in the

Q63: Create, Inc., a domestic corporation, owns 90%

Q67: The most common reason that corporate companies

Q89: Taxable income for purposes of § 179

Q92: Pablo, a sole proprietor, sold stock held

Q128: Jed is an electrician. Jed and his

Q140: Bruce, who is single, had the following

Q169: Jim acquires a new seven-year class asset