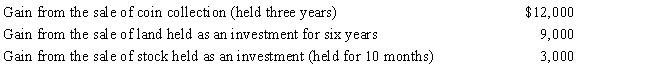

During 2016, Jackson had the following capital gains and losses:

a.How much is Jackson's tax liability if he is in the 15% tax bracket?

b.If his tax bracket is 33% (not 15%)?

Definitions:

Interest Expense

This is the cost incurred by an entity for borrowed funds over a period of time, typically expressed as an annual percentage.

Cost Of Goods Sold

The direct costs attributable to the production of the goods sold in a company, including materials and labor.

Dividends Paid

The part of a company's profits paid out to shareholders, typically as cash or shares.

Interest Expense

The cost incurred by an entity for borrowed funds; it is the price paid for the use of borrowed money, or, for corporations, the price paid for the use of borrowed capital.

Q4: Burt and Lisa are married and live

Q6: Office Palace, Inc., leased an all-in-one printer

Q9: On June 1, 2016, Red Corporation purchased

Q29: Discuss the treatment given to suspended passive

Q48: The holding period of property acquired by

Q64: Which of the following is NOT a

Q122: Tan Company acquires a new machine (ten-year

Q157: Cream, Inc.'s taxable income for the current

Q161: Rex, a cash basis calendar year taxpayer,

Q198: In the current year, Plum Corporation, a