Multiple Choice

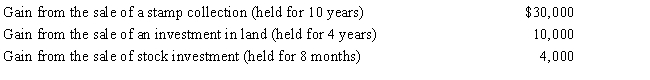

Perry is in the 33% tax bracket. During 2016, he had the following capital asset transactions:

Perry's tax consequences from these gains are as follows:

Definitions:

Related Questions

Q6: The most fundamental way that a business

Q64: During the current year, Maroon Company had

Q72: The local Liberal Party is a stakeholder

Q73: A surplus budget position means that an

Q96: Jack owns a 10% interest in a

Q106: Matt has three passive activities and has

Q113: On March 1, 2016, Lana leases and

Q173: For disallowed losses on related-party transactions, who

Q190: Under MACRS, if the mid-quarter convention is

Q194: Isabella owns two business entities. She may