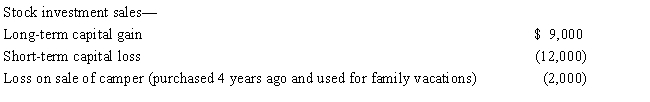

For the current year, David has wages of $80,000 and the following property transactions:

What is David's AGI for the current year?

Definitions:

Corporate Profits

The financial surplus gained by a company after all expenses and taxes have been deducted from total revenue.

Economic Environment

The combination of external economic factors that impact the operation of businesses, such as inflation, employment rates, and GDP growth.

Bankruptcy Codes

A set of federal laws outlined in the United States that govern bankruptcy proceedings and provide the legal framework for dealing with financial insolvency.

Labor Market Supply

The total pool of individuals available and qualified to work, determined by factors such as demographics, education, and willingness to work at prevailing wage rates.

Q11: Tara owns a shoe store and a

Q20: Walter sells land with an adjusted basis

Q23: If your company primarily borrows from commercial

Q32: Kirby is in the 15% tax bracket

Q41: Services performed by an employee are treated

Q61: For real property, the ADS convention is

Q63: A tax credit for amounts spent to

Q86: During the current year, Ryan performs personal

Q121: Ivory, Inc., has taxable income of $600,000

Q161: Why is it generally undesirable to pass