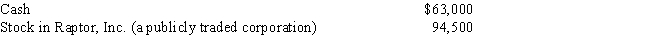

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for the year is $189,000. What is Ralph's charitable contribution deduction for the current year?

Definitions:

Reactance

A psychological response where individuals feel compelled to assert their freedom in reaction to perceived restrictions or coercion.

Attractiveness

The quality or combination of qualities that gives pleasure to the senses or pleasurably exalts the mind or spirit, often related to physical appearance but also including traits like charisma and intelligence.

Chemistry

The science that deals with the composition, structure, and properties of substances and the changes they undergo.

Sayonara

A Japanese word used to express goodbye.

Q22: On July 17, 2016, Kevin places in

Q26: A deferred tax liability represents a current

Q46: Tan, Inc., sold a forklift on April

Q66: Tonya had the following items for last

Q66: Morrisson, Inc., earns book net income before

Q73: Which of the following taxes are included

Q100: In the current year, Kelly had a

Q112: The holding period of replacement property where

Q127: Petal, Inc. is an accrual basis taxpayer.

Q169: Jim acquires a new seven-year class asset