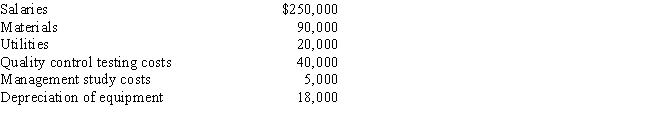

Last year, Green Corporation incurred the following expenditures in the development of a new plant process:

During the current year, benefits from the project began being realized in May. If Green Corporation elects a 60 month deferral and amortization period, determine the amount of the deduction for the current year.

Definitions:

Q59: If the taxpayer qualifies under § 1033

Q61: A sole proprietorship purchased an asset for

Q64: John files a return as a single

Q64: Milt's building which houses his retail sporting

Q71: Frank sold his personal use automobile for

Q73: Marsha transfers her personal use automobile to

Q91: In 2012, Harold purchased a classic car

Q177: Shontelle received a gift of income-producing property

Q203: Boyd acquired tax-exempt bonds for $430,000 in

Q205: If an election is made to defer