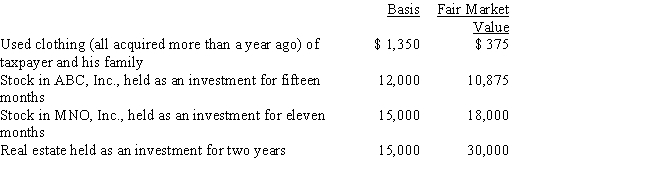

Zeke made the following donations to qualified charitable organizations during the year:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

Definitions:

Q14: The test for whether a child qualifies

Q31: What requirements must be satisfied to receive

Q34: Property used for the production of income

Q47: Tommy, an automobile mechanic employed by an

Q57: Five years ago, Tom loaned his son

Q101: Paula owns four separate activities. She elects

Q104: Hazel purchased a new business asset (five-year

Q105: Andrew, who operates a laundry business, incurred

Q114: If the alternate valuation date is elected

Q174: Under the alternative depreciation system (ADS), the