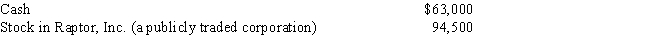

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for the year is $189,000. What is Ralph's charitable contribution deduction for the current year?

Definitions:

Utility Function

A mathematical representation of how individual preferences are aggregated to represent satisfaction or utility from consuming goods and services.

Marginal Utility

The additional satisfaction or benefit received by consuming one more unit of a good or service.

Budget Line

A representation of all possible combinations of two goods that an individual can afford given their income and the prices of the goods.

Income-Consumption Curve

A graphical representation showing how a consumer's optimal bundle of goods varies with changes in income.

Q18: ABC Corporation declared a dividend for taxpayers

Q43: White Corporation, a closely held personal service

Q60: Jake, the sole shareholder of Peach Corporation,

Q65: For tax purposes, there is no original

Q92: If a business debt previously deducted as

Q116: When determining whether an individual is a

Q127: Individuals who are not professional real estate

Q130: Mary incurred a $20,000 nonbusiness bad debt

Q149: Olive, Inc., an accrual method taxpayer, is

Q151: In computing the amount realized when the