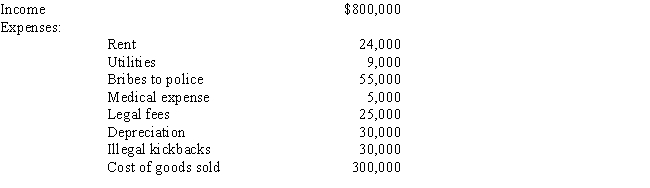

Albie operates an illegal drug-running business and has the following items of income and expense. What is Albie's adjusted gross income from this operation?

Definitions:

Direct Labor

The compensation and perks given to workers directly engaged in creating goods or delivering services.

Ceramic Tile

A durable, hard flooring material made from shaping and firing clay, often used for floors and walls.

Budgeted Unit Sales

An estimate of the number of units a company expects to sell over a certain period, often used for planning and strategic purposes.

Inventory Policy

A set of guidelines a company follows to determine the optimum levels of inventory to hold.

Q24: Kling Corporation reports a $150,000 cash tax

Q40: Amelia, Inc., is a domestic corporation with

Q44: Kate dies owning a passive activity with

Q64: Milt's building which houses his retail sporting

Q79: Gift property (disregarding any adjustment for gift

Q101: Augie purchased one new asset during the

Q102: If investment property is stolen, the amount

Q105: Calvin miscalculated his income in 2014 and

Q141: The surrender of depreciated boot (fair market

Q201: Molly exchanges a small machine (adjusted basis