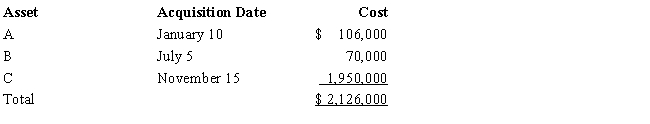

Audra acquires the following new five-year class property in 2016:

Audra elects § 179 treatment for Asset C. Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra claims the full available additional first-year depreciation deduction. Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Self-censorship

The voluntary suppression of one's thoughts, opinions, or information by individuals, often due to fear of social or official repercussions.

Psychological Safety

A work environment where individuals feel safe to take risks, voice their opinions, and be honest without fear of negative consequences.

Social Risks

The potential losses or negative consequences that arise from the social environment of a business, such as reputational damage or community opposition.

Work Stress

A form of stress that is caused by pressures or conflicts in a work environment, affecting an individual's mental and physical health.

Q9: Rajib is the sole shareholder of Robin

Q14: In some foreign countries, the tax law

Q38: A valuation allowance expresses on the GAAP

Q42: Rustin bought used 7-year class property on

Q52: Two years ago, Gina loaned Tom $50,000.

Q62: On June 1, 2016, Irene places in

Q73: The U.S. Tax Court meets most often

Q145: During 2016, Howard and Mabel, a married

Q147: Cole exchanges an asset (adjusted basis of

Q158: The stock of Eagle, Inc. is owned