Multiple Choice

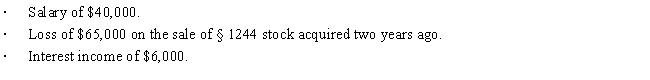

John files a return as a single taxpayer. In 2016, he had the following items:

Determine John's AGI for 2016.

Understand the shifting dynamics within the civil rights movement and the rise of Black nationalism.

Analyze the effects of conservative political strategies and rhetoric in shaping American politics.

Evaluate the long-term consequences of the 1960s social movements and policies on American society.

Understand the evolution and distinction between replacement planning and succession management.

Definitions:

Related Questions

Q3: Phyllis, Inc., earns book net income before

Q12: In the "rate reconciliation" of GAAP tax

Q20: Walter sells land with an adjusted basis

Q31: A lease cancellation payment received by a

Q33: Zork Corporation was very profitable and had

Q34: Sandra's automobile, which is used exclusively in

Q63: Which of the following assets held by

Q65: Maroon Corporation expects the employees' income tax

Q180: During the current year, Owl Corporation (a

Q188: Land improvements are generally not eligible for