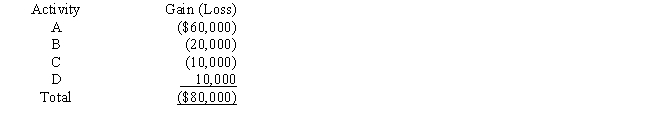

Hugh has four passive activities which generate the following income and losses in the current year.

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

Definitions:

Bookkeeping

A part of the accounting process that involves only the recording of economic events.

Accounting Process

The systematic series of steps taken to record financial transactions and prepare financial statements in accordance with accounting standards.

Working Knowledge

A practical understanding or awareness of a subject or skill, sufficient to perform tasks or make decisions related to it.

Accounting Relevance

The importance of financial information in making informed business decisions due to its material impact on evaluating past, present, or future events.

Q3: Josh has investments in two passive activities.

Q21: Under what circumstances may a taxpayer deduct

Q51: On July 20, 2015, Matt (who files

Q102: Turquoise Company purchased a life insurance policy

Q131: A theft loss is taken in the

Q156: During 2016, Sarah had the following transactions:<br>Sarah's

Q173: For disallowed losses on related-party transactions, who

Q178: Discuss the effect of a liability assumption

Q203: Boyd acquired tax-exempt bonds for $430,000 in

Q216: a.Orange Corporation exchanges a warehouse located in