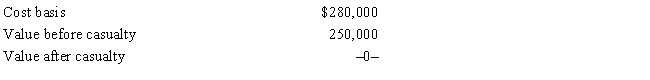

In 2016, Grant's personal residence was completely destroyed by fire. Grant was insured for 100% of his actual loss, and he received the insurance settlement. Grant had adjusted gross income, before considering the casualty item, of $30,000. Pertinent data with respect to the residence follows:

What is Grant's allowable casualty loss deduction?

Definitions:

Delayed Charge

A transaction that records an expenditure which will be billed to a client or customer at a future date, not immediately impacting cash flow.

Pending Expense

Expenditures that have been incurred but not yet fully processed or paid out.

Sales Transaction

A business operation where goods or services are exchanged for money between the seller and the buyer.

Invoice

A document issued by a seller to a buyer, itemizing a transaction and requesting payment for goods or services provided.

Q10: Anne sells a rental house for $100,000

Q19: You are assisting LipidCo, a U.S. corporation

Q35: Which of the following is not a

Q42: Jackson Company incurs a $50,000 loss on

Q65: Last year, Wanda gave her daughter a

Q84: Joyce's office building was destroyed in a

Q122: Michael is in the business of creating

Q139: If an owner participates for more than

Q160: The amount of a corporate distribution qualifying

Q211: The basis for depreciation on depreciable gift