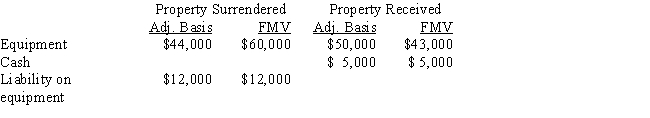

Sammy exchanges equipment used in his business in a like-kind exchange. The property exchanged is as follows:

The other party assumes the liability.

a.What is Sammy's recognized gain or loss?

b.What is Sammy's basis for the assets he received?

Definitions:

Participation

Active involvement or engagement in activities or events, often contributing to outcomes or processes.

Risks

Potential for experiencing harm or loss when engaging in an activity or situation.

Deception

The act of misleading or tricking someone into believing something that is not true.

Ethical

Pertaining to moral principles or the branch of knowledge dealing with these, often guiding conduct.

Q6: Patty's factory building, which has an adjusted

Q7: Debby, age 18, is claimed as a

Q14: On April 15, 2016, Sam placed in

Q14: Marginal income tax rate<br>A)Available to a 70-year-old

Q43: Tom, whose MAGI is $40,000, paid $3,500

Q44: All exclusions from gross income are reported

Q49: All collectibles short-term gain is subject to

Q76: Morgan owned a convertible that he had

Q86: If insurance proceeds are received for property

Q175: Annette purchased stock on March 1, 2016,