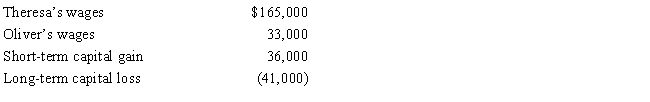

Theresa and Oliver, married filing jointly, and both over 65 years of age, have no dependents. Their 2016 income tax facts are:

What is their taxable income for 2016?

Definitions:

Income Tax Expense

The total amount of income tax a company is obligated to pay to the government, reported as an expense in the income statement.

Income Tax Rate

The percentage at which an individual or corporation is taxed on their income, which can vary based on income level, jurisdiction, and other factors.

After-Tax Discount Rate

A discount rate that has been adjusted for the effect of taxes, utilized in evaluating the net present value (NPV) of an investment after taxes.

Straight-Line Depreciation

A method of calculating the depreciation of an asset where its cost is evenly spread across its useful life.

Q20: Vertigo, Inc., has a 2016 net §

Q26: Nonrecaptured § 1231 losses from the six

Q56: Several years ago, John purchased 2,000 shares

Q58: Paula transfers stock to her former spouse,

Q79: Salaries are considered an ordinary and necessary

Q87: On their birthdays, Lily sends gift certificates

Q94: In 2015, Arnold invests $80,000 for a

Q129: Melody's adjusted basis for 10,000 shares of

Q145: During 2016, Howard and Mabel, a married

Q192: If a taxpayer reinvests the net proceeds