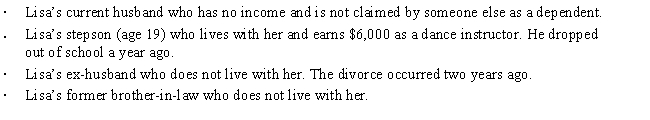

During 2016, Lisa (age 66) furnished more than 50% of the support of the following persons:

Presuming all other dependency tests are met, on a separate return how many personal and dependency exemptions may Lisa claim?

Definitions:

Partial Taxes

involve taxation on specific goods, services, or transactions, as opposed to broad-based taxes.

Shifted

Describes a change in position, direction, or tendency, often referring to shifts in market conditions, consumer preferences, or economic indicators.

Partnerships

A business structure where two or more individuals manage and operate a business in accordance with the terms and objectives set out in a Partnership Agreement.

Corporate Profits Tax

A tax imposed on the net income or profit earned by corporations, which can affect investment decisions and economic growth.

Q5: When a taxpayer has purchased several lots

Q22: Brian makes gifts as follows:<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5432/.jpg"

Q25: Pedro borrowed $250,000 to purchase a machine

Q38: Juanita owns 60% of the stock in

Q67: Adjusted gross income (AGI) appears at the

Q86: Mr. Lee is a citizen and resident

Q94: If the holder of an option fails

Q166: A qualifying child cannot include:<br>A)A nonresident alien.<br>B)A

Q167: Chaney exchanges a truck used in her

Q171: Kiddie tax applies<br>A)Not available to 65-year old