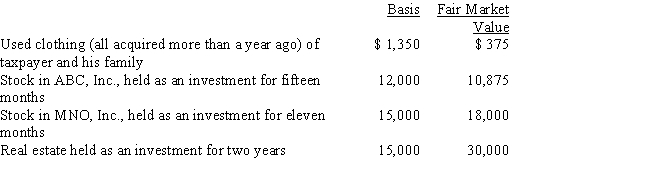

Zeke made the following donations to qualified charitable organizations during the year:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

Definitions:

Functional

Designed to be practical and useful, rather than attractive.

Chronological Format

A method of organizing information or events in the order that they occurred in time.

Professional History

A record or summary of an individual's work experience and qualifications.

Candidate's Strength

The unique qualities or abilities that a job applicant possesses, making them a suitable match for a specific role.

Q4: Bob lives and works in Newark, NJ.

Q9: A corporation must file a Federal income

Q11: Meal and entertainment expenses not deducted in

Q48: Azul Corporation, a calendar year C corporation,

Q50: The exclusion for health insurance premiums paid

Q56: Which of the following statements concerning the

Q78: Tracy and Lance, equal shareholders in Macaw

Q81: Judy paid $40 for Girl Scout cookies

Q86: Qualified moving expenses include the cost of

Q137: Albert transfers land (basis of $140,000 and