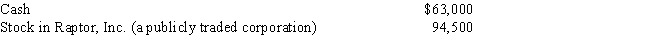

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for the year is $189,000. What is Ralph's charitable contribution deduction for the current year?

Definitions:

Core Self-Evaluations

A personality trait concept reflecting an individual’s subconscious, fundamental evaluations about themselves, their abilities and their control over their environment.

Increased Success

An improvement or growth in achieving goals, marked by measurable outcomes or achievements in personal or professional areas.

Positive Visual Imagery

Picturing a positive outcome in your mind.

Desired Outcome

The specific result or goal that an individual or group aims to achieve.

Q6: In 2016 Angela, a single taxpayer with

Q14: Discuss the relationship between realized gain and

Q28: Gain on installment sale in 2016 deferred

Q31: Donald owns a 45% interest in a

Q51: Charitable contribution carryforward deducted in the current

Q53: Rajib is the sole shareholder of Robin

Q69: For § 351 purposes, stock rights and

Q79: In the current year, Bo accepted employment

Q110: Once the actual cost method is used,

Q145: Ethan, a bachelor with no immediate family,