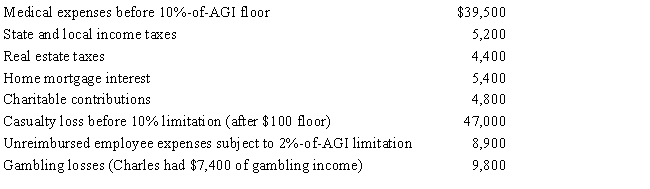

Charles, who is single and age 61, had AGI of $400,000 during 2016. He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Definitions:

Sex Objects

Refers to individuals viewed primarily through the lens of their sexual appeal or as objects for sexual gratification, ignoring their personal attributes or autonomy.

Glamorous

Associated with charm, allure, or attractiveness, often exuding an air of fascination or allure.

Modes of Interaction

Various forms or methods through which social entities (individuals, groups, institutions) engage and communicate with each other.

Rational Exchange

An interaction or transaction based on a calculated decision-making process, where individuals seek to maximize benefits while minimizing costs.

Q1: When computing current E & P, taxable

Q4: In general, how are current and accumulated

Q21: Earl and Mary form Crow Corporation. Earl

Q34: One indicia of independent contractor (rather than

Q40: Briefly define the term "earnings and profits."

Q47: Briefly discuss the rules related to distributions

Q48: Azul Corporation, a calendar year C corporation,

Q57: Phyllis, a calendar year cash basis taxpayer

Q101: The maximum credit for child and dependent

Q158: The taxpayer's marginal tax bracket is 25%.