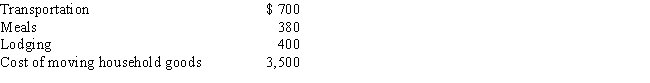

After graduating from college, Clint obtained employment in Omaha. In moving from his parents' home in Baltimore to Omaha, Clint incurred the following expenses:

a.How much may Clint deduct as moving expense?

b.Would any deduction be allowed if Clint claimed the standard deduction for the year of the move? Explain.

Definitions:

Dependency

A state of relying on or needing the support, help, or approval of someone or something else for emotional, physical, or financial security.

Talking Cure

A method of psychological treatment, particularly psychoanalysis, where verbal interaction is used as the primary therapeutic approach.

Defense Mechanisms

Psychological strategies used unconsciously by individuals to protect themselves from anxiety and to manage emotional conflict and internal or external stressors.

Case Study Method

A research methodology that involves an in-depth observation and detailed analysis of a single subject or entity to explore underlying principles or phenomena.

Q23: The CEO of Cirtronics Inc., discovered that

Q39: Check the box regulations<br>A)Organizational choice of many

Q55: A decrease in a taxpayer's AGI could

Q57: Gain on collectibles (held more than one

Q65: Eagle Corporation owns stock in Hawk Corporation

Q90: Federal income tax paid in the current

Q100: Adrienne sustained serious facial injuries in a

Q129: Williams owned an office building (but not

Q134: Jake performs services for Maude. If Maude

Q138: In 2016, Hal furnishes more than half