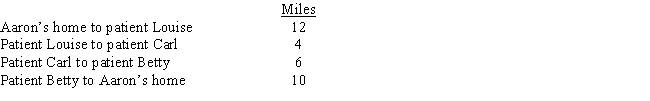

Aaron is a self-employed practical nurse who works out of his home. He provides nursing care for disabled persons living in their residences. During the day he drives his car as follows.

Aaron's deductible mileage for each workday is:

Definitions:

3M Company

An American multinational conglomerate known for its range of products including adhesives, abrasives, and laminates.

Low-Waste Approach

A strategy or lifestyle choice focusing on reducing the amount of waste generated by adopting practices like reusing, recycling, and choosing products that are made to last.

Built-In Obsolescence

is a design policy for products that ensures they become outdated or non-functional after a certain period, encouraging consumers to purchase new items.

Low-Waste Society

A society that emphasizes reducing the amount of waste generated through practices like reuse, recycling, and responsible consumption.

Q7: Brett owns stock in Oriole Corporation (basis

Q28: The § 1245 depreciation recapture potential does

Q49: A corporation borrows money to purchase State

Q56: Which of the following would be currently

Q68: State income tax paid in the current

Q75: Which, if any, of the following is

Q98: In determining whether the gross income test

Q116: The § 222 deduction for tuition and

Q127: A taxpayer may never recognize a loss

Q178: Corey is the city sales manager for