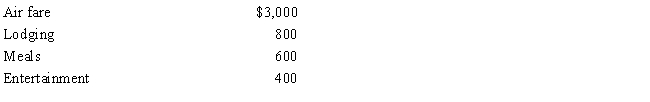

During the year, Sophie went from Omaha to Lima (Peru) on business. She spent four days on business, two days on travel, and four days on vacation. Disregarding the vacation costs, Sophie's unreimbursed expenses are:

Sophie's deductible expenses are:

Definitions:

Exercise

Physical activities undertaken to maintain or enhance health and fitness, including aerobic, strength, flexibility, and balance exercises.

Stress

The body's reaction to any change that requires an adjustment or response, which can be physical, mental, or emotional.

Sympathetic Nervous System

A part of the autonomic nervous system that prepares the body for physical activity by increasing heart rate, dilating bronchial passages, and decreasing motility of the large intestine.

Relaxation

A state of being free from tension and anxiety, often achieved through techniques such as meditation or deep-breathing exercises.

Q11: Meal and entertainment expenses not deducted in

Q16: The built-in loss limitation in a complete

Q16: Heloise, age 74 and a widow, is

Q18: Gain realized, but not recognized, in a

Q31: Olaf was injured in an automobile accident

Q46: Schedule M-2 is used to reconcile unappropriated

Q54: Sadie mailed a check for $2,200 to

Q116: Clara, age 68, claims head of household

Q140: Dawn, a sole proprietor, was engaged in

Q188: The Perfection Tax Service gives employees $12.50