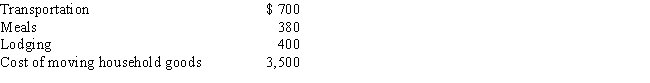

After graduating from college, Clint obtained employment in Omaha. In moving from his parents' home in Baltimore to Omaha, Clint incurred the following expenses:

a.How much may Clint deduct as moving expense?

b.Would any deduction be allowed if Clint claimed the standard deduction for the year of the move? Explain.

Definitions:

Van Buren Urethral Sound

A medical instrument used for dilating the urethra, typically employed in procedures involving the urinary tract.

Olsen Hegar Needle Holder

A surgical instrument used to hold needles during suturing, combining a needle holder and scissors.

U.S. Army Retractor

A surgical instrument used by medical personnel in the U.S. Army to hold back tissues or organs, enhancing visibility and access during surgery.

Richardson Retractor

A surgical instrument used to hold back the edges of a wound or incision to provide access to the underlying organs or tissues.

Q11: Laura is a real estate developer and

Q53: Dabney and Nancy are married, both gainfully

Q56: Jacob is a landscape architect who works

Q85: To determine E & P, some (but

Q95: Felicia, a recent college graduate, is employed

Q111: To ease a liquidity problem, all of

Q117: A taxpayer may not deduct the cost

Q132: A business machine purchased April 10, 2014,

Q143: During the current year, Doris received a

Q171: Kristen's employer owns its building and provides