Essay

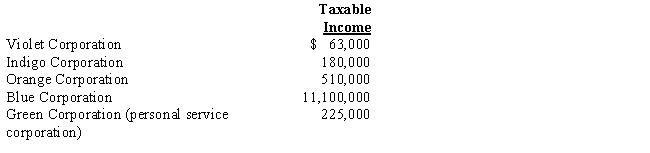

In each of the following independent situations, determine the corporation's income tax liability. Assume that all corporations use a calendar year 2016.

Definitions:

Related Questions

Q21: What statement is correct with respect to

Q29: Form 1120S provides an S shareholder's computation

Q47: In satisfying the support test and the

Q63: Which, if any, of the following items

Q67: A newly formed S corporation does not

Q80: Sarah's employer pays the hospitalization insurance premiums

Q93: Global system of taxation<br>A)Available to a 70-year-old

Q106: On January 1, Tulip Corporation (a calendar

Q136: A distribution of cash or other property

Q179: Nicole's employer pays her $150 per month