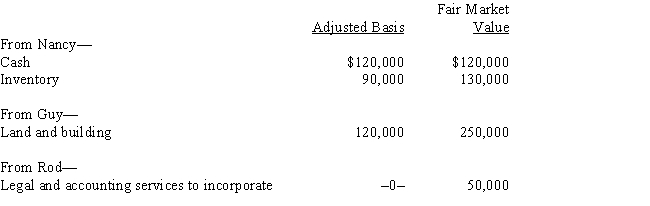

Nancy, Guy, and Rod form Goldfinch Corporation with the following consideration.

Goldfinch issues its 500 shares of stock as follows: 250 to Nancy, 200 to Guy, and 50 to Rod. In addition, Guy gets $50,000 in cash.

a.Does Nancy, Guy, or Rod recognize gain (or income)?

b.What basis does Guy have in the Goldfinch stock?

c.What basis does Goldfinch Corporation have in the inventory? In the land and building?

d.What basis does Rod have in the Goldfinch stock?

Definitions:

Q17: During the current year, MAC Partnership reported

Q18: Arizona is a(n) _ property state for

Q34: Which of the following statements regarding the

Q45: Leona borrows $100,000 from First National Bank

Q53: Separately stated items are listed on Schedule

Q94: A state can levy an income tax

Q98: A taxpayer who uses the automatic mileage

Q109: Which of the following statements is correct

Q148: Employees of the Valley Country Club are

Q162: Tax Rate Schedule<br>A)Available to a 70-year-old father