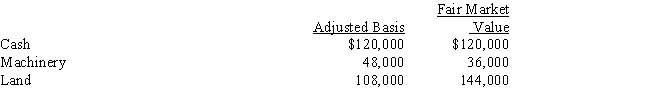

Hazel transferred the following assets to Starling Corporation.

In exchange, Hazel received 50% of Starling Corporation's only class of stock outstanding. The stock has no established value. However, all parties believe that the value of the stock Hazel received is the equivalent of the value of the assets she transferred. The only other shareholder, Rick, formed Starling Corporation five years ago.

Definitions:

Marital Status

A legally defined condition relating to an individual's marriage situation, such as single, married, divorced, or widowed.

Fair Debt Collection Practices Act

A U.S. statute established to eliminate abusive debt collection practices by debt collectors, and to promote fair debt collection.

Misrepresenting

Providing false or misleading information or statements, often with the intent to deceive.

Obsolete

Obsolete describes an item, technology, or procedure that is out of date or no longer produced or used, often because it has been replaced by newer versions or alternatives.

Q4: Pablo, a sole proprietor, sold stock held

Q8: Penny, Miesha, and Sabrina transfer property to

Q17: For the current year, Wilbur is employed

Q19: Unused foreign tax credits are carried back

Q26: Characteristic of a taxpayer who is self-employed<br>A)Must

Q26: At the beginning of the current year,

Q37: Dana, age 31 and unmarried, is an

Q41: The taxpayer is a Ph.D. student in

Q72: On January 2, 2015, David loans his

Q98: Letha incurred a $1,600 prepayment penalty to