Helene Corporation owns manufacturing facilities in States A, B, and C. A uses a three-factor apportionment formula under which the sales, property and payroll factors are equally weighted. B uses a three-factor apportionment formula under which sales are double-weighted. C employs a single-factor apportionment factor, based solely on sales.

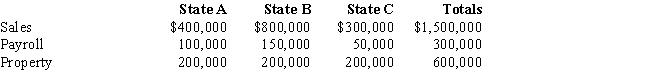

Helene's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows.

Helene's apportionable income assigned to A is:

Definitions:

Stock Repurchase Program

A plan initiated by a company to buy back its own shares from the marketplace, reducing the number of outstanding shares.

Special Dividend

A one-time, non-recurring dividend paid by a company to its shareholders, usually reflecting exceptionally good earnings.

2-for-1 Stock Split

A corporate action where a company divides its existing stock into two, reducing the price of each share for investors while maintaining the overall value of their investment.

Information Content Effect

The impact on a company's stock price when new information becomes available to market participants.

Q24: Pressure ulcer of right elbow with partial

Q25: Waltz, Inc., a U.S. taxpayer, pays foreign

Q30: Flip Corporation operates in two states, as

Q31: Amit, Inc., an S corporation, holds an

Q71: An item that appears in the "Other

Q77: Barb and Chuck each own one-half of

Q88: Blue, Inc., has taxable income before salary

Q95: Sale of corporate stock by the S

Q105: Amos contributes land with an adjusted basis

Q123: Why does stock redemption treatment for an