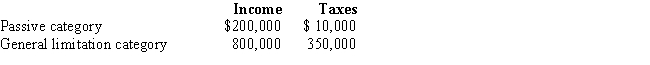

Britta, Inc., a U.S. corporation, reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S. taxes before FTC are $560,000 (assume a 35% tax rate). What is Britta's U.S. tax liability after the FTC?

Definitions:

Time Horizon

The length of time over which an investment, project, or policy is intended to exist or be effective, influencing planning and decision-making processes.

Replacement Chart

A visual tool used in human resources planning, showing potential successors for key positions within an organization, often highlighting gaps or development needs.

HR Forecasting Document

A strategic document used by human resources to predict future HR needs, including staffing requirements and skill shortages.

Resistance To Change

The reluctance or refusal to adapt to changes in the workplace or operational environments, often due to fear of the unknown or loss of status or job security.

Q3: Direct infection of the left ankle due

Q11: Laura is a real estate developer and

Q24: Items that are not required to be

Q53: An unlisted procedure code:<br>A)is a procedure or

Q70: Explain the OAA concept.

Q75: Maria owns 75% and Christopher owns 25%

Q88: Several individuals acquire assets on behalf of

Q88: AMTI may be defined as regular taxable

Q101: Limited partnership<br>A)Contribution of appreciated property to the

Q111: Any distribution of cash or property by