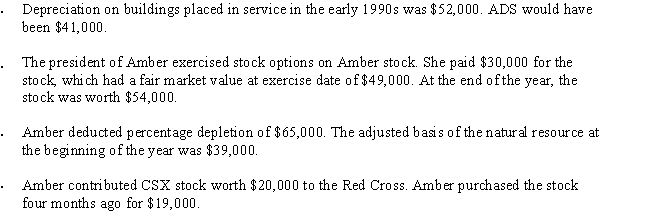

Amber, Inc., has taxable income of $212,000. In addition, Amber accumulates the following information which may affect its AMT.

What is Amber's AMTI?

Definitions:

Break-Even Point

The point at which total costs and total revenues are equal, meaning no profit or loss occurs.

Bearish

A market sentiment indicating an expectation that stock prices will decline.

Put

An options contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified time.

Investment Insurance

A financial product or strategy that provides protection against losses in one's investment portfolio, often through methods such as hedging or insuring a certain value of assets.

Q1: What is the HCPCS Level II code

Q11: During the year, Green, Inc., incurs the

Q19: The correct reporting for Staphylococcus pneumonia:<br>A)E86.0, J41.0<br>B)J18.9,

Q29: Stenger Test<br>A)See Uroflowmetry<br>B)See Audiologic Function Test; Ear,

Q42: Retinal migraine.<br>ICD-10-CM Code: _

Q55: Some _and taxation rules apply to

Q81: Palmer contributes property with a fair market

Q83: Tax-exempt income at the corporate level flows

Q106: Albert and Elva each own 50% of

Q146: For a C corporation to be classified