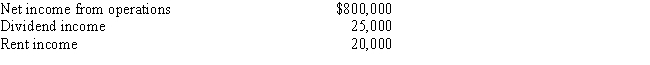

Catfish, Inc., a closely held corporation which is not a PSC, owns a 45% interest in Trout Partnership, which is classified as a passive activity. Trout's taxable loss for the current year is $250,000. During the year, Catfish receives a $60,000 cash distribution from Trout. Other relevant data for Catfish are as follows:

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

Definitions:

Q5: subcutaneous<br>A)IT<br>B)IV<br>C)IM<br>D)SC<br>E)IHN

Q6: An S election made before becoming a

Q20: According to the CPT manual, modifier -91

Q24: An S corporation is not subject to

Q28: During 2016, Miles Nutt, the sole shareholder

Q29: Subsequent encounter for malunion of displaced fracture

Q47: Ventricular angiography cardiac catheterization imaging services, interpretation,

Q61: The AMT exemption for a corporation with

Q62: Which of the following is NOT a

Q73: Which item does not appear on Schedule